The Basics of Personal Finance

Personal finance can seem super intimidating—after all, it covers all the decisions you make with your money throughout your life. But trust us, it doesn’t have to be complicated! When you break it down, you’ll see personal finance as very manageable steps that you can and will get a handle on. So, let’s do just that:

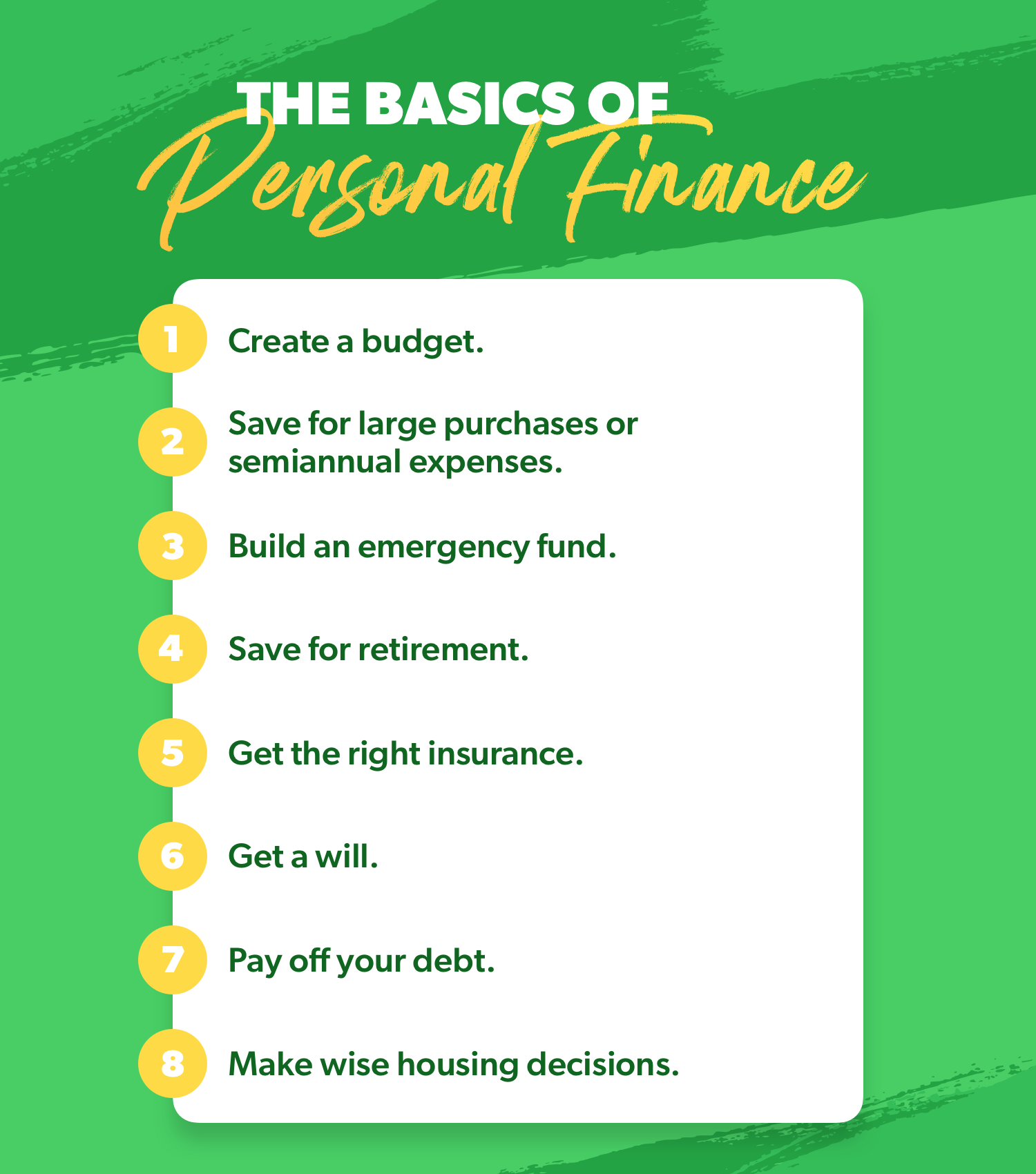

Create a Budget.

First things first: You need to create a budget. Why? Budgeting is the foundation you’ll build all the rest of your personal finance on top of. That’s because budgeting, plain and simple, is making a plan for your money—every dollar coming in and every dollar going out. Here’s how to do that:

First, identify your income. Income is any money you plan to receive during that month. That includes take-home pay and any side hustle money.

Next, you’ll subtract all your expenses. Start by covering your Four Walls: food, utilities, shelter and transportation. Then start listing common monthly expenses like insurance and childcare. If there’s still money left, list out extras like eating out and entertainment.

Start budgeting with a free trial of Ramsey+ today!

If you have money left when you’ve subtracted all your expenses, give yourself a high five. But don’t leave it as “extra.” Put that money to work toward your current money goal, like saving or paying off debt. If you end up with a negative number, you need to cut expenses until your income minus your expenses equals zero.

The final tip for budgeting (and it’s one of our top personal finance tips, period) is this: Track. Your. Expenses. Do it all month long. This means any money that goes in or out of your bank account needs to be put into your budget—into the right budget line. This is how you stay on top of your spending, keep from overspending, and get real with your money habits. Because your budget is the plan, and tracking is the accountability.

Save for Large Purchases or Semiannual Expenses.

Not every expense in your life happens on a regular, monthly routine. You should use a sinking fund to save up for these bit by bit, like if . . .

- Your car tires are beginning to wear thin—start saving for replacements.

- You’ve got an insurance premium that’s due twice a year—divide the cost and save part of the total each month.

- You have an annual membership to something—again, divide the cost and save some each month.

- You want to work on home repairs or buy new furniture—save up until you can pay in full.

A sinking fund is a great way to save up for large expenses and semiannual expenses because you can budget for them over time to spread out the cost. Then your budget isn’t blindsided by something you knew was coming up.

Build an Emergency Fund.

Your grandmother told you to save for a rainy day. Why? Because. It. Rains. She called it a rainy day fund—we call it an emergency fund. And if ever a year has made the need for an emergency fund obvious, it was 2020.

Begin with a $1,000 starter fund. Then once you’ve paid off all your debt (we’ll cover that more later), use that extra cash you were spending on debt payments to build your fully funded emergency fund. Here’s how you’ll do that:

First, look at your budget. How much does it take to keep your household running each month? If your income went away, what essential bills and obligations would you still have to meet? You want to save enough to cover three to six months of those expenses in case of an emergency. (That’s three months if you’ve got a two-income household and six months if you’ve got one income.)

Keep this money liquid, aka make sure it’s available. Your emergency fund isn’t a long-term investment. It’s insurance—and it needs to be at the ready if you need it. This doesn’t mean you stuff it in between your mattress and box spring—that’s a little too available. Instead, stash that cash into a simple money market account so you can get to it by writing a check or going to an ATM, but it’s not sitting there with your regular money as a temptation when summer vacay comes around. (That’s not an emergency, just to be clear, no matter how much you crave salty air.)

With your fully funded emergency fund in place, you’ll be ready for whatever comes your way. That kind of personal finance security will help you sleep better than the softest pillow in the world.

Save for Retirement.

Retirement investments aren’t as intimidating as you might think. First let’s talk about how much to invest. When you follow the Baby Steps, you’ll start socking away 15% of your income into retirement investments once you’ve paid off all your debt and saved up that fully funded emergency fund we just talked about.

When you’re at that point, here’s how you jump in: See if your employer offers a 401(k) (or 403(b)) with a match. If they do, invest in your 401(k) up to the employer match to take advantage of that free money! If your 401(k) is traditional (meaning you fund it with pretax money), the next move you should make is to open a Roth IRA—which you fund with after-tax dollars, allowing your growth and withdrawals down the road to be tax-free! But since the Roth gives you such a big tax advantage, Uncle Sam puts a cap on it: You can only invest $6,000 in 2021. If you max that out and still haven’t hit 15%, go back to your 401(k) and keep investing your money there.

Inside both the 401(k) and Roth IRA, you’ll want your money spread across the four kinds of mutual funds: growth, growth and income, aggressive growth, and international. That way you don’t invest all your eggs into one retirement basket. It’s technically called diversification in the investing world, and it’s less risky and just plain wise.

Here’s an important callout: When you’re trying to figure out how much money you need saved to retire, it’s all about figuring out what bestselling author and retirement expert Chris Hogan calls your R:IQ (aka your Retire Inspired Quotient). This will show you that magic amount you need saved up so you can live the retirement of your dreams. To figure it out, check out Hogan’s retirement calculator. It does the math for you and shows you exactly how much money to invest each month based on your age, income and retirement lifestyle goals.

Get the Right Insurance.

Insurance is so fun, right? Right? Okay—maybe not for most of us. But that doesn’t make it any less essential. And maybe you know you’re supposed to get insurance, but you don't really know what kind or how much or with who.

Don’t you worry. Here’s a super quick rundown of the eight types of insurance you need:

- Auto: Generally, for car insurance, you need full coverage, which includes liability, collision and comprehensive. If you’ve got an older, paid-for car, you can think about dropping collision. There are a few other optional types and some that are required by law in your state. It’s a good idea to talk to an independent insurance agent to go over your options and get the best rates.

- Homeowner’s or Renter’s: If you’re a homeowner, make sure you have extended dwelling coverage and talk to your agent about flood and earthquake coverage. If you’re renting, know your landlord is not responsible for replacing your stuff if it’s lost in a fire, burglary or other disaster. You need a renter’s policy!

- Umbrella Policy: If your net worth is over $500,000, you need an umbrella policy to protect your home and savings in case something big happens that goes beyond your home and auto insurance coverage. Not fun to think about, but necessary!

- Health Insurance: One major medical emergency can literally bankrupt you if you don’t have health insurance. But if you’re worried about the cost of medical insurance, consider a high-deductible health insurance plan combined with a Health Savings Account (HSA). This is a great way to protect yourself in an emergency without paying an absurd amount for coverage each month.

- Long-Term Disability: Get yourself long-term disability insurance that covers you if you become unable to work because of sickness or injury. You’ll need enough to cover 65% of your current income. You don’t need short-term disability. (Your fully funded emergency fund will cover you there.)

- Term Life Insurance: Life insurance is all about protection and security. You need a 15- or 20-year term life insurance policy for 10–12 times your annual, pretax income. Term life will save you $300 a month over whole life—and term life isn’t a total rip-off like whole life, which plays dress up like an investment policy with a sucky rate of return. (No thank you.)

- Long-Term Care Insurance: If you end up needing long-term care in your golden years, don’t expect Medicare to take care of you. That generally isn’t enough to cover your costs. So, when you turn 60, plan to get a long-term care policy that covers in-home care (not just nursing homes).

- Identity Theft Protection: There were 13 million victims of identity fraud in 2019.1 Listen: Identity theft can happen to anyone and can take up to 600 hours to clean up on your own. You need identity theft protection! Make sure you get a plan that offers both protection and recovery services. You need Social Security number monitoring, change of address monitoring, recovery services and reimbursement. That means someone else will plug in those 600 hours to get your life back in order when you need it!

Yeah, that’s a lot. But don’t worry: You don't have to be an insurance expert to be well insured. (Thank goodness!) But you do have to be proactive. Try our 5-Minute Coverage Checkup. It's easy, quick and clear—three of our favorite words in this hustle and bustle world. Plus, you might even save some cash—three more of our favorite words!

Get a Will.

We’re just going to come out and say it: You need a will. It’s part of getting your personal finances in order, and part of being a responsible adult—not a fun part, but an important part. You don’t want the government to decide what happens to your stuff, your money or your family (which is exactly what will happen if you don’t take charge here).

Yes, it’s a lot to deal with—making huge decisions about something you don’t really want to think about in the first place. But listen, you need a will. Find yourself an affordable, online provider who cuts the legal jargon and simplifies the process. (By simple, we mean do-the-paper-work-in-your-pajamas simple.) So, don’t put it off. Get a will today.

Pay Off Your Debt.

Some people think debt is a tool to build credit or get fancy airline miles. The truth is, debt is a weight that presses you down and holds you back. Nearly half (46%) of Americans say their debt level creates stress and makes them anxious.2 That could be because debt keeps you from ever getting ahead. It holds part of your paycheck hostage every month with payments for something you bought months or even years ago. You don’t need that kind of stress!

Here’s a massively important personal finance tip: Your income is your greatest wealth-building tool. When you pay off your debt, you take back your paycheck. You get back those extra payments you were making toward debt. What could you do with that extra money? Use it for extra room in the budget. Use it to move forward with your money goals, like savings and your retirement! Use it for you.

To summarize: Debt is not a tool. Your income is. Take. It. Back.

Make Wise Housing Decisions.

We could make this one really complicated. But that’s not our thing. Our thing is making personal finance clear and simple. So, here are the three main points you need to take with you when you’re thinking about making wise housing decisions.

- Don’t spend more than 25% of your take-home pay on housing costs. If you own your home, that means your mortgage payment, PMI, property taxes, insurance and any HOA fees combined shouldn’t be more than 25%. If you rent, the rent and any other fees connected shouldn’t be more than 25%.

- Get a 15-year, fixed-rate conventional mortgage. (It has the overall lowest cost.)

- Save at least 10–20% of the home’s cost for a down payment before you buy a house.

Without following those three guidelines, you can quickly become house poor—meaning your house might be awesome, but it takes up so much of your income that you struggle financially in other areas.

So, yeah, personal finance is a lot. But you can totally handle it. You can make better decisions with your money—big and small. So you can get more wins with your money—big and small.

If you want a helping hand and some serious guidance along the way, check out Ramsey+. With this all-access membership, you’ll learn everything personal finance without the confusing financial blah blah blah everyone else is dishing out. Plus, you’ll get the tools you need to make wise money moves—big and small. Right now, you can give it a test-drive in a Ramsey+ free trial.