How Much to Save for Retirement

How Much to Save for Retirement

When you think ahead to your golden years, it may seem like an overwhelming journey to get there—especially if you factor in the stops along the way. Many of those stops are expensive, too, like getting out of debt, buying a home, and stockpiling money for your kids’ college funds. It’s a lot to plan for. It’s a lot to save for. And how the heck do you know how much to save for retirement anyway?

Let’s find out!

![]()

How Much Money Is Enough for Retirement?

Retirement is a big goal. It requires a good deal of money made from years of working and saving and investing. How much, exactly, is enough? And how can you get to that wonderful destination of your dream retirement?

One (Baby) step at a time!

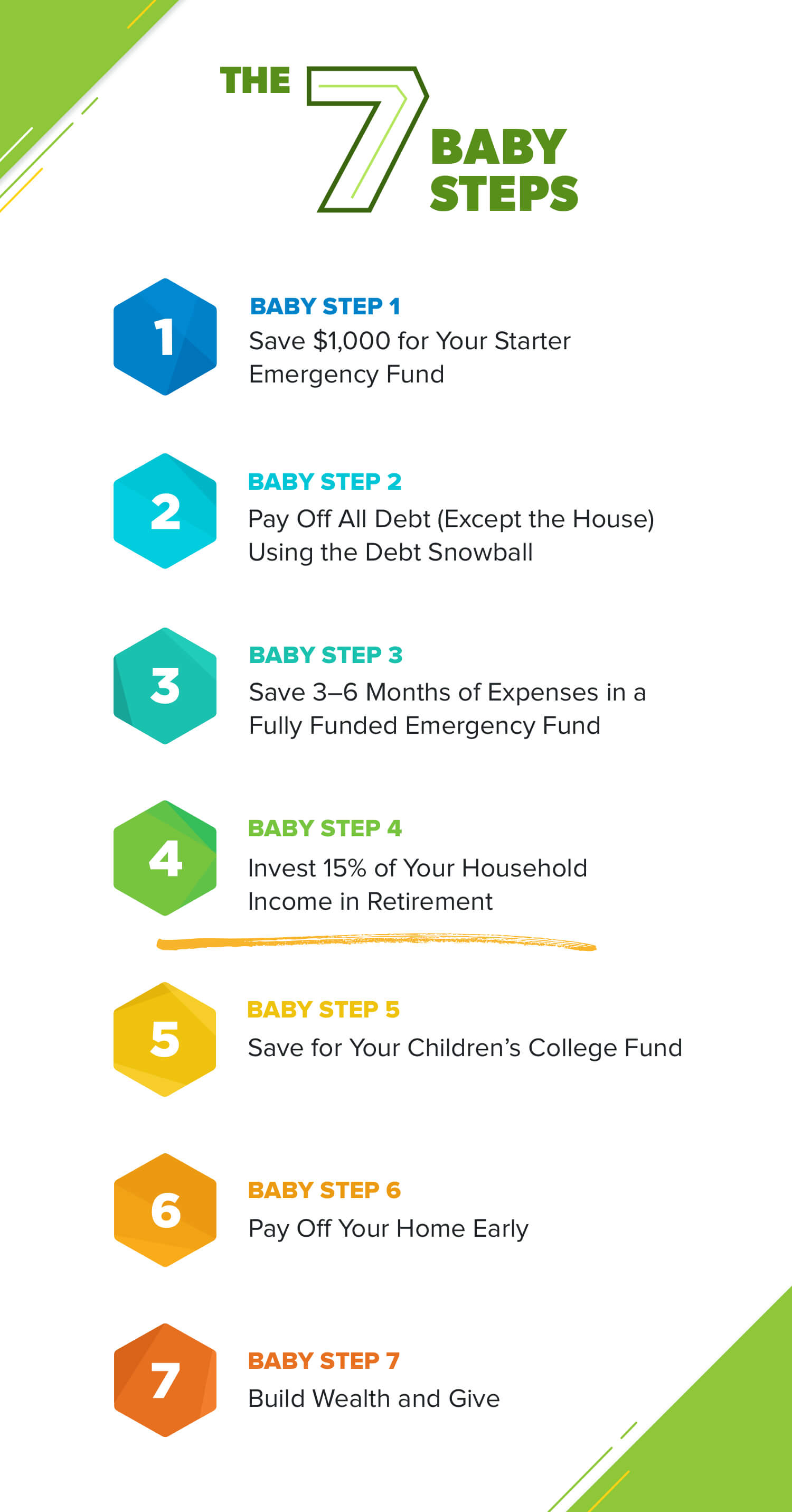

Follow the Baby Steps.

When we talk about saving for retirement, we start with percentages. EveryDollar recommends contributing 15% of your household income into tax-advantaged retirement accounts to retire comfortably.

The timing of this is very important, though. It may sound a little crazy, but don’t start investing for later until you’ve gotten yourself into a financially stable situation now. This means following the Baby Steps.

Here’s why it isn’t crazy (not even a little) to hold off on investing in retirement until Baby Step 4.

Notice those first three Baby Steps are all about avoiding and paying off debt. They propel you to a debt-free lifestyle so you can start thinking about the future while living in the security of the present. The first $1,000 emergency fund keeps you going while you crush your debt. And that full emergency fund you save up in Baby Step 3 means you always have cash ready—so you don’t even think about running back to your borrowing ways.

At that point, you’re in the right place to start investing by putting 15% of your household income into retirement savings.

Use a retirement calculator.

In the words of our good friend Chris Hogan—a bestselling author, Ramsey Personality, and financial expert—“Retirement isn’t an age. It’s a financial number.” What he means is this: Your retirement goal shouldn’t be about the age you want to retire. It should be about saving up the right amount of money to live the retirement of your dreams.

So, what is that number? You need to find out your R:IQ (aka your Retire Inspired Quotient). Don’t worry—there’s no middle school math teacher peering over your shoulder and insisting you make use of the Pythagorean theorem. Chris Hogan’s crew designed a retirement calculator that does the math for you and shows you exactly how much money to invest each month based on your age, income and retirement lifestyle goals.

So the answer to the question “how much money is enough for retirement” isn’t one-size-fits-all. It’s specific to you and your dreams. And the R:IQ tool is ready, willing and able to tell you the number that’s just the right fit for you.

![]()

Is 15% Enough?

Are you unsure if 15% is enough? Let’s explain where that number came from.

When you’re on the Baby Steps journey, you’ll actually be working on Baby Step 4, Baby Step 5, and Baby Step 6 all at the same time. (You can look back that that Baby Steps image if you need a reminder of the flow.) As soon as you get up to 15% of your income going toward retirement, it’s time to start saving for the kids’ college fund and to start paying more on that mortgage to get it gone for good.

Investing 15% of your gross income leaves you enough wiggle room to do all those things at the same time. However, if you don’t have kids, if your kids have left the nest, or if your mortgage is already a thing of the past, then you can start investing even more for retirement.

Let’s do some math breakdown for you. Since we don’t know what your 15% is, we’re picking a number that’s easy for everyone to relate to—a figure that could easily cover a dinner out or a week’s worth of daily, seasonally flavored lattes: $35.

Let’s see what kind of future $35 a week could afford you if you invested in good growth stock mutual funds. If you’re doing the math, that would be 15% of an approximately $12,000 salary—$3,000 less than what you’d bring home in a year if you worked 40 hours a week at the federal minimum wage.

So 40 years of turning down one meal out with the fam each week could make you a millionaire? That’s an option worth chewing on.

![]()

Is It Too Late to Start Investing?

Probably. Sorry about your luck.

Of course we’re joking. It’s not hopeless! You can begin investing right now and still set yourself up for retirement. If you’re starting later in life than you’d prefer, just use these tips.

Pick up the pace.

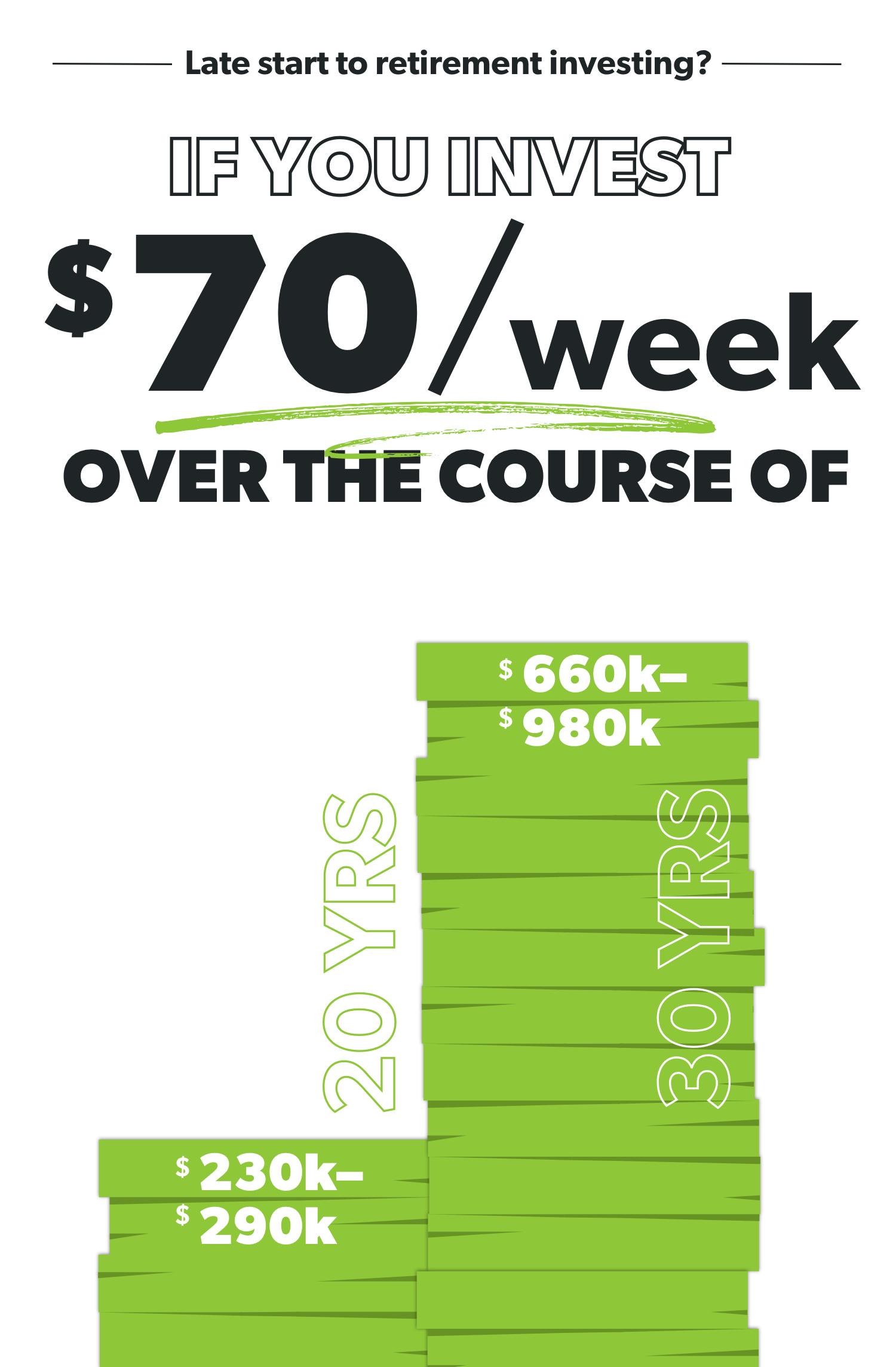

Boost your retirement budget by bringing home a little extra bacon (or some black bean bacon, if you’re a vegetarian) and rolling it into your nest egg. Look at the numbers below to see how some extra contributions can make a big difference.

Work a few extra years.

There’s no rule that says you have to retire at 65. If you’re 45 years old, adding five more years to your timeline and retiring at 70 could boost your savings from $200,000 to $270,000 if you continue to contribute just $35 a week.

Pay off your mortgage.

This is a big one, but think about how much further your money could go without a mortgage hanging over your head. It might mean sacrificing a bigger home in the short term, but it will be worth it in the long term.

The median monthly mortgage payment these days is $1,500.1 Without that big chunk of change coming out of your budget each month, you’d have so much more to invest (before retirement) and so much less to pay for (during retirement).

![]()

What Are Ways You Can Start Saving Now?

Retirement isn’t tomorrow’s problem. Prepping for it starts today. So how can you start saving now? Use these three tips:

Start with your company’s 401(k) option.

Don’t overlook the value of your employer’s 401(k). If you have this offering and you’re able to, max out the amount of contributions you can put into this fund. Right now, that would be $18,500 a year of your own money (not counting the employer match, if you have one).

After that, you’ll call in reinforcements such as the Roth IRA, which allows you to contribute up to $5,500 a year. And remember, that employer match isn’t part of the 15% you’re investing. It’s just a lovely little bonus.

Cut back on your spending in other areas.

To free up even more money to put toward retirement, you need to use your most powerful wealth-building tool (your income) to its max potential. And that means cutting back your spending in other areas so you have more money to invest.

When looking at the expenses that come your way each month, categorize them as fixed/essential expenses (like your mortgage or rent, utilities, food and transportation) or common monthly expenses (such as restaurants, entertainment and clothing).

The key words here are fixed and essential: That means there isn’t a lot of room to trim up those expenses, unless you want to make a big change like downsizing your home. So the other places you spend money—the “extras” technically—are where you cut back.

Evaluate often.

Things change. That’s something you can count on. You have kids. You move. Your kids go to college. Your kids become financially stable on their own. You get a promotion. You take a dream job that pays less money.

All these life changes—plus plenty of others—are reasons to evaluate your retirement goals and to check in on your R:IQ, how much you’re investing, and when you’ll be able to retire.

The best way to keep up with it all, through changes and the day-to-day normal life, is by budgeting. When you’re on Baby Step 4, you should have a place in the budget for your retirement savings. If your income changes, you’ll need to adjust your other budget lines so that you’re still saving for the future.

It’s easy to make room in your budget for retirement savings with EveryDollar—you just add in a budget line! That’s how you get intentional about investing.

Simply follow these steps:

-

Scroll to the bottom of your budget on the desktop version.

-

Click “ADD GROUP.”

-

Name it something like “Retirement Savings.”

-

Then click “Add Item.”

-

Label your investments.

Boom. Just like that, you’ve started budgeting for retirement. It has a place in your monthly money plan, so it won’t be a loose dream of “one day.” It’s now a solid goal you’re working on each day.

You can do this! You don’t have to rely on your kids or the government (which is straight up gambling with your future). You can have the money you’ll need to live a fantastic retirement. It’s all about investing the right amount at the right time and being intentional with your budget.

Start budgeting today for the tomorrow of your dreams.